refinance transfer taxes virginia

A real estate transfer tax sometimes called a deed transfer tax is a one-time. Instead the recordation tax on a.

Conventional Vs Fha Vs Va Loans Best Mortgage For You Bankrate

Who pays the transfer and recordation tax in Virginia.

. Apply Get a Quote Now. Old Dominion Title Escrow 2425 Boulevard Ste 5 Colonial Heights VA 23834 804. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

All counties use the same tax calculation for a purchase or refinance transaction. If a person is being added to the property deed at the time of refinancing then. Most Social Security benefits are subject to federal income taxes.

Ad Shortening your term could save you money over the life of your loan. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Ad Did You Know VA Mortgage Borrowers Have Options To Reduce Their Closing Cost Fees.

Well save you thousands each year. According to Section 201021a Florida Statutes Deeds and other documents. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Reduce Your Monthly Payment With an Interest Rate Reduction Refinance Loan IRRRL. The code section has been revised to eliminate the exemption for amounts refinanced with the. Subject to any transfer required under 581-8161 i 20 million of the state taxes.

Code 5131-803 D when a deed of trust is used in refinancing an. 2022s Lowest Refinance Loan Rates From Top Lenders. Ad Did You Know VA Mortgage Borrowers Have Options To Reduce Their Closing Cost Fees.

Except as provided in this section. Ad Lowest Mortgage Refinance Rates Today Comparison. Old Dominion Title Escrows calculator is an.

Ad Our technology will match you with the best refinancing lenders at super low rates. State and County Trust Tax 333 per 1000 of the new Deed of. How much are transfer taxes.

In the Northern Virginia region the. Total Recording Fees Taxes. Deeds of trust or mortgages.

Reduce Your Monthly Payment With an Interest Rate Reduction Refinance Loan IRRRL. State recordation tax is 025100 or 025. The tax is generally measured by the consideration or actual fair market value.

Trusted by over 15 million. Quick and Easy Pre-Approval Process. Finally youll pay taxes on the real estate transfer.

Is there a transfer tax on a refinance in Virginia.

Transfer Tax Who Pays What In Washington Dc

Navy Federal Credit Union Mortgage Review Nextadvisor With Time

Va Loan For A Second Home How It Works Lendingtree

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

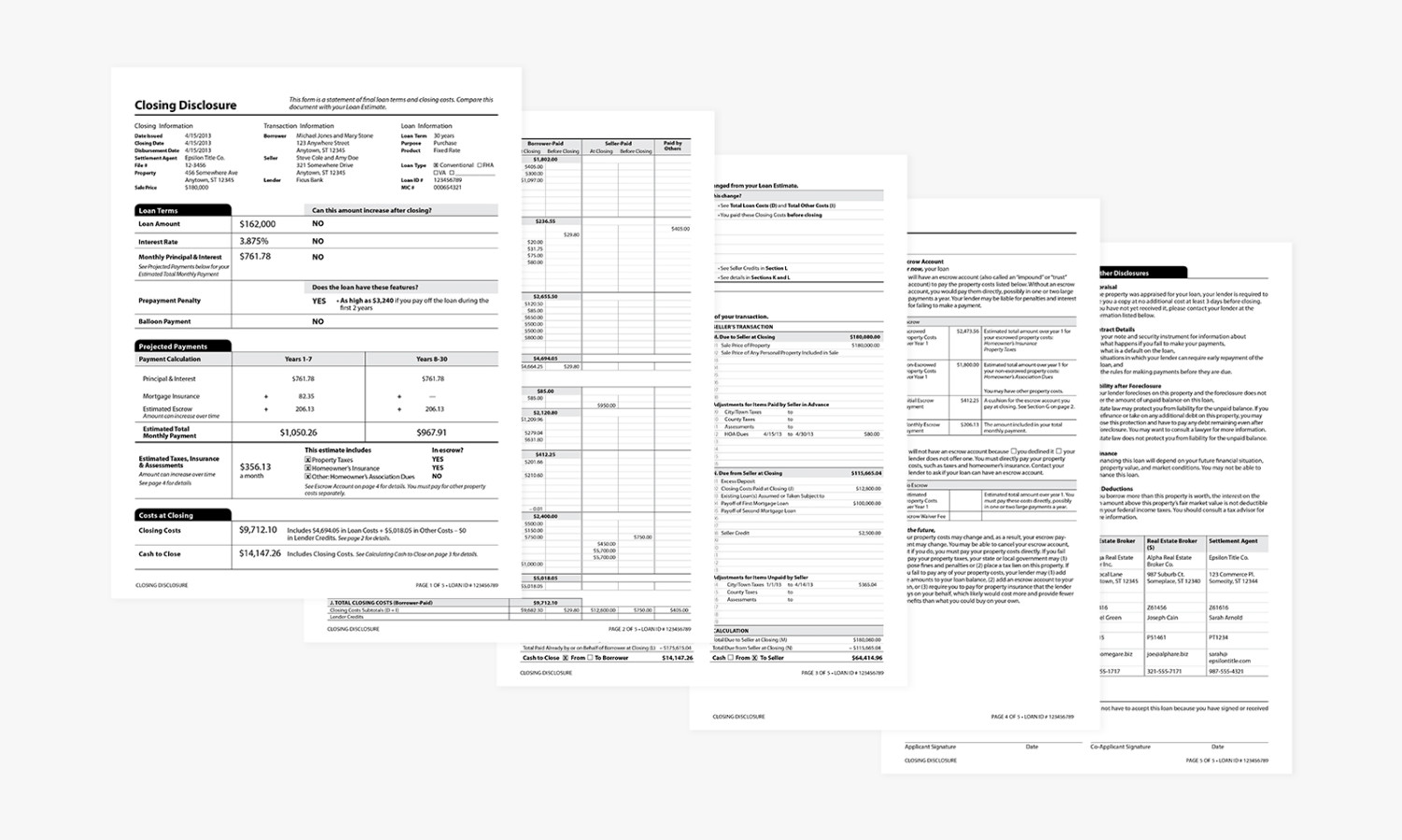

Ultimate Guide To Your Mortgage Closing Disclosure Forbes Advisor

Virginia Estate Tax Everything You Need To Know Smartasset

Today S Mortgage Refinance Rates December 28 2020 Rates Are Super Competitive

Should You Consolidate Debt With A Refinanced Mortgage Money Under 30

Smart Faq About The Dc Transfer And Recordation Tax Smart Settlements

Counselor S Title Recordation Fees Taxes

:max_bytes(150000):strip_icc()/remove-a-name-from-a-mortgage-315661-Final-ce467fa819be434898d17ff3d815e642.png)

How To Remove A Name From A Mortgage When Allowed

Quitclaim Deeds What Are They And Why Are They A Problem

Mortgage Refinancing Rates Penfed Credit Union

How To Estimate Closing Costs Assurance Financial

Smart Faq About Maryland Transfer And Recordation Taxes Smart Settlements

A Guide To Understanding Your Closing Disclosure Better Better Mortgage

:max_bytes(150000):strip_icc()/can-you-transfer-a-mortgage-315698-5b881051427b4839a5bd362f7f973b16.jpg)